Free HMO Valuation Tool

Our HMO valuation calculator can help you understand how much you can make from your HMO. If you're struggling to decipher the potential rental price for a single room, this calculator could be a tremendous help. Simply plug in your information below and work out your potential profits now. Start by typing your prefered postcode then select from the drop down before pressing search.

Room Types Available

Start your 7 day free trial!

Only £24.99 per month after your 7 day free trial

Easy To UseInvestment Dashboards

Intuitive real-time dashboards show all local data at the touch of a button. See asking HMO rents, yields, planning applications and more for specific postcodes or your own custom area.

Some Of Our Trusted Sources

Start your 7 day free trial!

Only £24.99 per month after your 7 day free trial

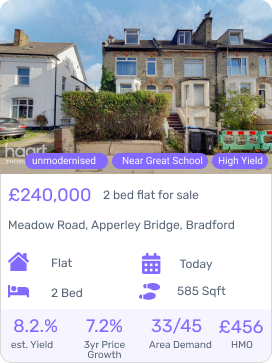

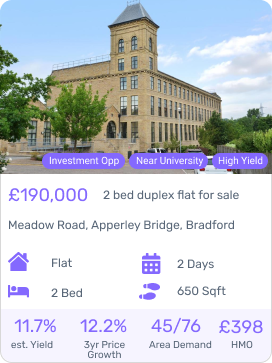

Investment Focused Listings

Instant overviews of every listing on the market giving you the essential metrics at a glance, allowing you to identify opportunities quickly and easily.

Get in on the action.

Then, only £24.99/mo. after your trial.

Frequently Asked Questions

How are HMOs valued?

HMO properties can be valued in two ways: 1) Standard brick & mortar property valuation 2) Commercial HMO valuation. In the majority of cases, a standard brick & mortar valuation will be used. This is common when a property is a standard single C3 dwelling. The property will be valued by a surveyor who will analyse the condition of the property and the local comparables. In some cases depending on the situation, commercial HMO valuation is used. This will in most cases give a higher valuation compared to the brick and mortar method and will be built on a yield-based method. In most cases, investors who are looking to release capital from a property will look for a commercial valuation in order to draw down more capital with a higher valuation.

Are HMO properties worth more?

HMO properties can be up to 3x more valuable than standard long-term rental properties. A key element of the valuation is the achievable rental income and yield of the HMO. Our free valuation tool above will allow you to get accurate HMO rates for the local area of your property. With that data, you can then multiply this out depending on the characteristics of your property and calculate the estimated income of each room.

Will HMO devalue your property?

HMO properties are generally valued higher than standard properties. However, where there has been an article 4 direction issued in the area it can devalue the property as the long-term ability to hold an HMO licence will be in doubt. When buying a HMO property you should always check on the local area and any newly issued planning directives. If you lose your license you would have to reapply for permission which is not likely after an article 4 direction has been issued as it looks to reduce the amount of HMO properties in the area. The property will sell for a lower value as the main buyer will potentially be regular homeowners who will have to convert the property back to a standard use case.

What is a good ROI for HMO properties?

When buying a property and converting to an HMO, you should expect an ROI of 15-20%. Running an HMO property can be more time-consuming and require greater start-up costs.

Is there demand for HMOs?

Since the pandemic, the demand for HMO properties has been rising. The increased demand has been seen mainly for high-quality properties. This leaves a fantastic opportunity for investors to capitalise on this increased demand for high-quality shared living in fast-growing cities such as London and Manchester.